Bucharest, November 19, 2020 – International tech and innovation company QUALITANCE and Raiffeisen Bank have announced today the development of a 100% digital lending platform for small and medium enterprises. The product, which is currently undergoing testing with a limited number of Raiffeisen Bank customers, will become available to all the bank’s SME customers in 2021, as a result of a continuous implementation of new functionalities.

The development of the digital platform has started this year with the ultimate goal of providing small and medium-sized enterprises with an outstandingly efficient experience that would accelerate their development in the current context. The entire flow of bank operations, from sending customer offerings all the way to loan disbursement, will be fully automated and expertly reduced to just a couple of minutes. The benefits most appreciated by the companies that have tested the digital platform include the high speed and efficiency of the lending process as well as the simple, user-friendly experience resulting from the elimination of bureaucracy and visits to the bank. In every design and development stage of the platform, a great emphasis was put on simplifying the customer’s interactions with the bank, while ensuring the data security for the end-user.

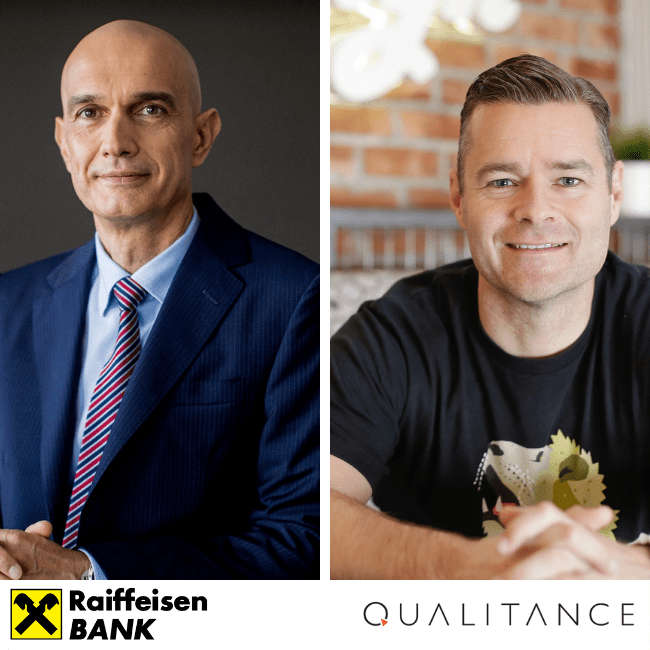

“The pandemic context has shown us that the need for small and medium enterprises to access funding for support and development is not only real, but also immediate. Therefore, together with QUALITANCE, we have accelerated the development of this digital platform, paying close attention to the specific needs and challenges of our customers. We have intensively tested the entire platform experience with a small group of companies, and the positive feedback we have received so far is motivating us to continue our development effort and to make it possible for all our SME customers to use this efficient lending tool by the end of next year,” stated Vladimir Kalinov, Vice President of Retail Raiffeisen Bank.

“We are honored that, together with Raiffeisen Bank, we have the opportunity to help small and medium-sized companies overcome such challenging times. This first success in our collaboration is the result of a full-speed journey, during which in record time we managed to reduce complexity and financial stress for companies. Our satisfaction is all the greater as we found in Raiffeisen Bank a partner who is fully dedicated to creating long-term impact for their customers,” added Mike Parsons, CEO of QUALITANCE.

The digital lending platform created by Raiffeisen Bank and QUALITANCE was designed and developed between March and November, and at present is undergoing continuous testing with some of the bank’s customers. The platform was built on a scalable microservices architecture that integrated with the bank’s existing systems, based on methodologies such as Agile, design thinking, and rapid prototyping.

About Raiffeisen Bank

The 4% increase in the loan portfolio in the first 9 months of 2020 confirms that Raiffeisen Bank continued to finance the economy at a steady pace. The bank participates in the SME Invest program and has approved loans worth over 1,2 billion lei. Raiffeisen Bank supports the growth of Romanian micro-enterprises through the European program for employment and social innovation “EaSI” (EU Program for Employment and Social Innovation), facilitating their access to loans of up to 120,000 lei, without guarantees. Launched in September 2020, the new microcredit program targets small companies that have difficulty accessing traditional financing services. Also, small SME farmers benefited from support by pre-financing APIA subsidies, at the end of Q3 there are over 840 beneficiary clients, with a total of over 210 million lei. Through another European program, “COSME” (Competitive Small Medium Enterprise) approximately 200 SMEs have accessed financing of over 50 million lei in 2020. In addition, the bank also participates in the implementation of the government grant program for SMEs, worth almost 1 billion euros.

Raiffeisen Bank has over 20 years of activity on the Romanian banking market and over 2.1 million customers, individuals, and legal entities. The bank has over 4,900 employees, 340 agencies nationwide, 750 ATMs, 370 multifunctional machines (MFMs) and a network of over 24,000 POS.

About QUALITANCE

QUALITANCE is an international technology and innovation company that creates digital products and businesses for global organizations and startups. QUALITANCE uses experience design, rapid prototyping, and emerging technologies such as AI and Machine Learning to create innovative digital products and services and help large organizations step in the hyper-scalable 21st-century digital economy.

In 13 years of existence, the company has built a team of nearly 200 talented people across 3 continents – Europe, US & Australia, and has worked with some of the world’s biggest companies such as News Corp, Virgin, IKEA, IBM, Johnson & Johnson, and Ford on digital transformation and innovation solutions.

QUALITANCE has been recognized by the Financial Times 1000, Deloitte Technology Fast 50 Central Europe, Inc.5000 Europe, and Deloitte Technology Fast 500 EMEA as one of the fastest-growing technology companies. In 2017, QUALITANCE was awarded Company of the Year by the Employers Association of the Software and Services Industry (ANIS). In 2018, the Bucharest Stock Exchange presented QUALITANCE with the Made in Romania Award for being one of the companies that will contribute to the growth of the national economy.

No Comments